Investing

Investing is a fundamental aspect of building wealth and securing a financial future. It involves putting money into various assets with the expectation of generating returns. Learn about different investment strategies and asset classes and how to create a diversified portfolio. Explore the principles of risk and return, the importance of long-term investing, and the role of financial planning in successful investing.

Discover various investment strategies, asset classes, and how to build a diversified portfolio to achieve your financial goals.

Frequently Asked Questions

Investing involves putting your money into assets or financial instruments with the expectation of generating a return or profit. This can include buying stocks, bonds, real estate, mutual funds, or other investment vehicles. Investing aims to grow your money over time and achieve financial objectives, such as saving for retirement, purchasing a home, or funding education.

Starting with investing can seem daunting, but breaking it down into manageable steps can help. Begin by setting clear financial goals and determining your risk tolerance. Educate yourself on different types of investments and how they work. Consider starting with low-cost index funds or exchange-traded funds (ETFs) offering minimal risk diversification. Additionally, using a robo-advisor or seeking advice from a financial advisor can help you create an investment strategy that aligns with your goals.

There are several types of investments to consider, each with its own risk and return profile:

- Stocks: Shares of ownership in a company that can provide capital gains and dividends.

- Bonds: Debt securities issued by corporations or governments that pay interest over time.

- Real Estate: Property investments that generate rental income and appreciate value.

- Mutual Funds: Investment funds that pool money from many investors to purchase a diversified

portfolio of stocks, bonds, or other assets. - Exchange-Traded Funds (ETFs): Investment funds traded on stock exchanges that hold a

diversified portfolio of assets. - Cryptocurrencies: Digital currencies that operate on blockchain technology and can offer high-

risk, high-reward opportunities.

Managing investment risk involves diversifying your portfolio, understanding your risk tolerance, and investing in a mix of assets that align with your financial goals. Diversification spreads your investments across different asset classes to reduce the impact of any single investment’s poor performance. Regularly reviewing and rebalancing your portfolio can help manage risk and align your investments with your long-term goals.

Diversification is crucial in investing as it helps spread risk across various asset classes and investment types. Diversifying reduces the risk that any investment will negatively impact your overall portfolio. This approach can help you achieve more stable returns and protect your assets from significant losses.

Key Terms

Inflation is the rate at which the general price level of goods and services rises, eroding purchasing power. Central banks use monetary policy to manage inflation and ensure it remains within target ranges.

Learn more about inflation and its impact on the economy.

The degree of variability in investment returns an individual is willing to withstand. Understanding your risk tolerance helps you choose investments that match your comfort level with potential losses.

A measure of the profitability of an investment is calculated by dividing the net profit by the initial investment cost. It helps evaluate the efficiency of an investment.

Divide your investment portfolio among asset classes, such as stocks, bonds, and real estate, to balance risk and reward based on your financial goals.

An investment strategy involves spreading investments across various asset classes and sectors to reduce risk and improve potential returns.

A digital platform that provides automated, algorithm-driven financial planning services with minimal human supervision. Robo-advisors typically offer portfolio management based on your risk tolerance and investment goals.

Index funds are a type of mutual fund or ETF that aims to replicate the performance of a specific market index, such as the S&P 500. They provide broad market exposure and are often low-cost.

Investing wisely requires understanding your financial goals, risk tolerance, and investment options. You can work towards achieving financial stability and growth by employing effective strategies and utilizing the right tools.

Bankruptcy is a legal process that relieves individuals who cannot repay their debts. While it can eliminate or restructure debt, it has serious long-term consequences for your credit.

The debt-to-income (DTI) ratio measures your total monthly debt payments compared to your gross monthly income. Lenders use this ratio to assess your ability to manage monthly payments and repay debts.

The loan term is the time you have to repay a loan. Longer terms typically result in lower monthly payments but more interest paid over time.

Related Post

-

David Harper

- 16 Aug 2024

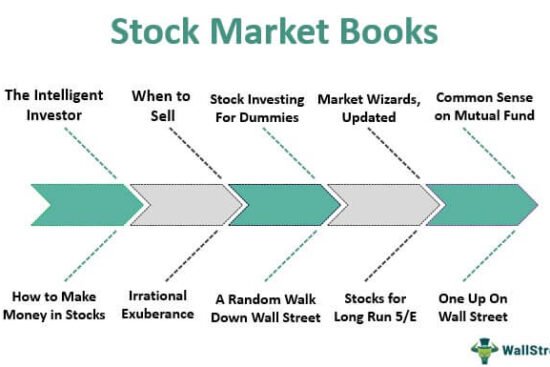

Essential Stock Market Books: Top 10 Picks for Investors

The ever-evolving world of the stock market can feel like a complex labyrinth, brimming with jargon and shrouded in a…

-

David Harper

- 16 Aug 2024

Profit Strategies: How to Make Money in Stocks

The allure of the stock market lies in its potential to generate significant returns and build wealth over time. While…

-

David Harper

- 12 Jul 2024

Artificial Intelligence in Investing Predictive Analytics and Algorithms

Unveiling the Future: Artificial Intelligence in Investing The financial landscape is undergoing a revolution fueled by artificial intelligence (AI). Imagine…

-

MFS

- 12 Jul 2024

Value vs Growth Stocks Choosing the Right Investment Strategy

The Investment Balancing Act: Value vs. Growth Stocks Imagine standing in an art gallery, facing two captivating paintings. One, a…

-

MFS

- 12 Jul 2024

SPACs Special Purpose Acquisition Companies What You Should Know

Unveiling the Mystery: A Guide to SPACs (Special Purpose Acquisition Companies) The financial world can feel like a labyrinth of…

-

MFS

- 12 Jul 2024

NFTs and Blockchain Investing in Digital Assets

Demystifying the Digital Gold Rush: NFTs and Blockchain - Investing in a New Frontier (1500 Words) The digital age has…