Best Investment Apps for August 2024

Investment apps provide convenient ways to manage your investments and track financial goals. Learn about the best investment apps available, their features, and how they can enhance your investment strategy. Discover which apps offer tools for portfolio management, stock analysis, and investment tracking, and find the one that aligns with your investment needs and preferences.

Find out which investment apps are best for managing your investments, their features, and how they can help you achieve your financial goals.

Frequently Asked Questions

When choosing an investment app, consider the following features:

- Ease of Use: The app should have an intuitive interface that makes navigating and managing your investments easy.

- Investment Options: Look for apps that offer a range of investment options, including stocks, ETFs, mutual funds, and cryptocurrencies.

- Fees and Commissions: Consider the app’s fee structure, including trading fees, account maintenance fees, and any hidden costs.

- Research and Tools: A good investment app should provide research tools, market analysis, and educational resources to help you make informed decisions.

- Security: Ensure the app has robust security measures to protect your personal and financial information.

For beginners, the following apps are often recommended due to their user-friendly interfaces, educational resources, and low fees:

- Robinhood: Offers commission-free trading and a simple interface, making it ideal for new investors. It also provides essential educational resources.

- Acorns: Automatically invests spare change from your daily purchases into a diversified portfolio. It’s excellent for beginners who want a hands-off investment approach.

- Stash: Provides educational content and allows you to invest with as little as $5. It offers a variety of investment options and personalised advice.

Advanced investors might prefer apps with sophisticated features, in-depth research tools, and advanced trading options:

- TD Ameritrade: Known for its powerful thinkorswim platform, which offers advanced charting tools, technical analysis, and a wide range of investment options.

- E*TRADE: Provides a comprehensive trading platform with advanced features, research tools, and various investment products.

- Interactive Brokers: Offers a high level of customization, low-cost trading, and access to a broad range of markets and investment products.

Yes, several apps offer automated investing or robo-advisory services, which use algorithms to manage your investments based on your goals and risk tolerance:

- Betterment: Provides automated portfolio management with personalized financial advice and goal-based investing strategies.

- Wealthfront: Offers automated investment management and financial planning tools, including tax-loss harvesting and financial planning.

- Merrill Guided Investing: Combines automated investment management with personalized guidance from financial advisors.

Investment apps typically use several security measures to protect your data and investments:

- Encryption: Data encryption to secure your personal and financial information.

- Two-Factor Authentication (2FA): An additional layer of security requiring a second form of verification.

- Secure Socket Layer (SSL) Protocols: Protects data transmitted between your device and the app’s servers.

- Insurance: Many apps are insured by the Securities Investor Protection Corporation (SIPC) to protect your assets in case of a broker failure.

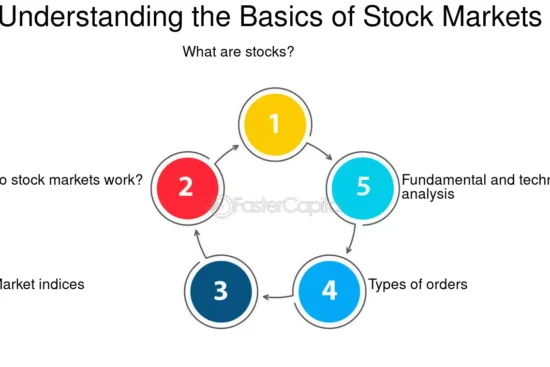

Key Terms

It has automated investment platforms that use algorithms to create and manage a diversified portfolio based on your financial goals and risk tolerance.

An investment strategy involves spreading investments across various assets to reduce risk and enhance potential returns.

ETFs are investment funds traded on stock exchanges, similar to individual stocks. They typically hold a diversified portfolio of assets.

Investment funds that pool money from multiple investors to invest in a diversified portfolio of stocks, bonds, or other assets.

A feature of some investment apps that automatically adjusts your portfolio to maintain your desired asset allocation.

An investment strategy used to offset capital gains by selling investments at a loss to reduce taxable income.

A security measure requiring two forms of verification to access your account, enhancing protection against unauthorized access.

The practice of borrowing funds from a broker to trade larger positions than your account balance would otherwise allow.

Related Post

-

David Harper

- 16 Aug 2024

Mastering Stock Market Dynamics: How Prices Move and Why

With its ever-fluctuating numbers and cryptic jargon, the stock market can seem like a complex and intimidating realm. Yet, beneath…

-

David Harper

- 16 Aug 2024

Introduction to Stock Investing Building Wealth and Managing Risks

The world of finance can seem like a complex labyrinth filled with jargon and intimidating charts. Stock quotes flicker across…

-

David Harper

- 16 Aug 2024

Exploring Options: Leveraging Strategies for Advanced Investors

The investment landscape offers diverse opportunities, catering to investors of all experience levels. While a solid foundation in core principles…

-

David Harper

- 16 Aug 2024

Navigating Market Volatility: Strategies for Stability

With its relentless ticker tape spewing numbers and jargon, the stock market can feel like a complex machine hurtling through…

-

David Harper

- 16 Aug 2024

Demystifying Bonds and Commodities: Alternative Investment Avenues

The stock market might dominate the financial headlines, but a successful investor knows the importance of venturing beyond the familiar.…

-

David Harper

- 16 Aug 2024

Understanding Stocks: Basics, Analysis, and Portfolio Strategies

Imagine yourself strolling through a bustling marketplace, but instead of fruits and vegetables, the stalls overflow with tiny pieces of…