Best Investment Apps for August 2024

Investment apps provide convenient ways to manage your investments and track financial goals. Learn about the best investment apps available, their features, and how they can enhance your investment strategy. Discover which apps offer tools for portfolio management, stock analysis, and investment tracking, and find the one that aligns with your investment needs and preferences.

Find out which investment apps are best for managing your investments, their features, and how they can help you achieve your financial goals.

Frequently Asked Questions

When choosing an investment app, consider the following features:

- Ease of Use: The app should have an intuitive interface that makes navigating and managing your investments easy.

- Investment Options: Look for apps that offer a range of investment options, including stocks, ETFs, mutual funds, and cryptocurrencies.

- Fees and Commissions: Consider the app’s fee structure, including trading fees, account maintenance fees, and any hidden costs.

- Research and Tools: A good investment app should provide research tools, market analysis, and educational resources to help you make informed decisions.

- Security: Ensure the app has robust security measures to protect your personal and financial information.

For beginners, the following apps are often recommended due to their user-friendly interfaces, educational resources, and low fees:

- Robinhood: Offers commission-free trading and a simple interface, making it ideal for new investors. It also provides essential educational resources.

- Acorns: Automatically invests spare change from your daily purchases into a diversified portfolio. It’s excellent for beginners who want a hands-off investment approach.

- Stash: Provides educational content and allows you to invest with as little as $5. It offers a variety of investment options and personalised advice.

Advanced investors might prefer apps with sophisticated features, in-depth research tools, and advanced trading options:

- TD Ameritrade: Known for its powerful thinkorswim platform, which offers advanced charting tools, technical analysis, and a wide range of investment options.

- E*TRADE: Provides a comprehensive trading platform with advanced features, research tools, and various investment products.

- Interactive Brokers: Offers a high level of customization, low-cost trading, and access to a broad range of markets and investment products.

Yes, several apps offer automated investing or robo-advisory services, which use algorithms to manage your investments based on your goals and risk tolerance:

- Betterment: Provides automated portfolio management with personalized financial advice and goal-based investing strategies.

- Wealthfront: Offers automated investment management and financial planning tools, including tax-loss harvesting and financial planning.

- Merrill Guided Investing: Combines automated investment management with personalized guidance from financial advisors.

Investment apps typically use several security measures to protect your data and investments:

- Encryption: Data encryption to secure your personal and financial information.

- Two-Factor Authentication (2FA): An additional layer of security requiring a second form of verification.

- Secure Socket Layer (SSL) Protocols: Protects data transmitted between your device and the app’s servers.

- Insurance: Many apps are insured by the Securities Investor Protection Corporation (SIPC) to protect your assets in case of a broker failure.

Key Terms

It has automated investment platforms that use algorithms to create and manage a diversified portfolio based on your financial goals and risk tolerance.

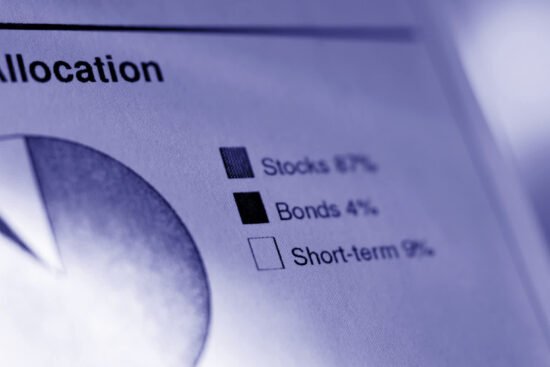

An investment strategy involves spreading investments across various assets to reduce risk and enhance potential returns.

ETFs are investment funds traded on stock exchanges, similar to individual stocks. They typically hold a diversified portfolio of assets.

Investment funds that pool money from multiple investors to invest in a diversified portfolio of stocks, bonds, or other assets.

A feature of some investment apps that automatically adjusts your portfolio to maintain your desired asset allocation.

An investment strategy used to offset capital gains by selling investments at a loss to reduce taxable income.

A security measure requiring two forms of verification to access your account, enhancing protection against unauthorized access.

The practice of borrowing funds from a broker to trade larger positions than your account balance would otherwise allow.

Related Post

-

MFS

- 23 Sep 2024

The Emergence of Visual Finance: Using Data Art to Invest Your Way to Prosperity

Visual Finance is a new field that has arisen over the past few years at the nexus of art and…

-

MFS

- 19 Sep 2024

Beyond Crypto: How Tokenized Assets Are Reshaping Wealth Management

The ascent of blockchain innovation and digital currencies has ignited huge changes in the monetary world, yet the capability of…

-

David Harper

- 29 Aug 2024

Investing 101: How to Start Your Investment Journey with Confidence

Contributing is fantastic for creating financial stability and ensuring your monetary future. Nonetheless, it can appear overwhelming for those new…

-

MFS

- 29 Aug 2024

Building Wealth 101: A Beginner’s Guide to Saving and Investing

Creating financial momentum is an objective that many yearn for, yet it frequently feels overpowering, particularly for novices. Nonetheless, anybody…

-

David Harper

- 27 Aug 2024

Investment Strategies for Different Life Stages: Age, Goals, and Risk Tolerance

Investing is a dynamic journey that evolves with your life stages, goals, and risk tolerance. Understanding how to adapt your…

-

David Harper

- 27 Aug 2024

Tax-Efficient Investing: Guide to Minimizing Tax Liabilities

Tax-efficient investing is a crucial component of financial planning, aiming to maximize after-tax returns by strategically minimizing tax liabilities. By…