With its ever-fluctuating numbers and cryptic jargon, the stock market can seem like a complex and intimidating realm. Yet, beneath the surface lies a fascinating dance of supply and demand, psychology, and economic forces influencing how stock prices move. Understanding these dynamics is crucial for confidently navigating the market, whether you’re a seasoned investor or just starting out. This guide delves into the intricate world of stock market dynamics, explaining the factors that drive price movements and equipping you to make informed investment decisions.

The Ever-Shifting Landscape: Supply and Demand in Action

Imagine an auction house for tiny slices of company ownership – that’s essentially what the stock market is. Companies sell shares (supply) to investors who want to buy them (demand). The price of a stock hinges on the balance between these two forces. The price tends to rise when there are more buyers than sellers (high demand). Conversely, if more sellers want to offload their shares than there are buyers (high supply), the price usually falls.

Beyond the Basics: Factors Influencing Stock Prices

While supply and demand form the foundation, many factors influence stock price movements. Let’s explore some key players in this market drama:

- Company Performance: A company’s financial health is a major driver of its stock price. Strong earnings, innovative products, and a positive outlook for the future can attract investors and push the price up. Conversely, declining profits, negative news, or industry headwinds can lead to investor skepticism and a price decline.

- Economic Conditions: The economy’s overall health significantly impacts the stock market. When the economy is booming, investor confidence tends to be high, leading to a rise in stock prices across sectors. Conversely, economic downturns breed pessimism, often resulting in widespread stock market declines.

- Interest Rates: The Federal Reserve’s interest rate decisions affect stock prices. When interest rates are low, borrowing money becomes cheaper, making investments in stocks more attractive. Conversely, higher interest rates make stocks less appealing as alternative investments like bonds offer higher returns with lower risk.

- Investor Sentiment: The collective mood of investors can significantly impact stock prices. When optimistic (bullish), investors are more likely to buy stocks, driving prices higher. On the other hand, fear and pessimism (bearish sentiment) can lead to sell-offs, pushing prices down. This herd mentality can create short-term market fluctuations.

Technical Analysis: Reading the Tea Leaves in Charts

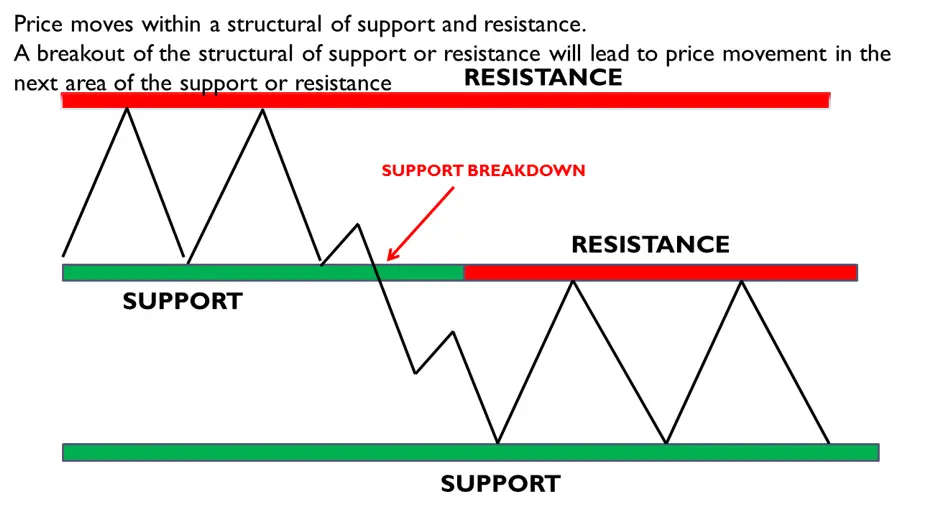

Technical analysis studies historical price charts and trading patterns to identify potential future trends. Analysts use technical indicators like moving averages and relative strength index (RSI) to gauge investor sentiment, support, and resistance levels (price points where buying/selling pressure is concentrated), as well as potential breakout points. However, it’s crucial to remember that technical analysis is not a crystal ball – past performance doesn’t necessarily guarantee future results. It should be used in conjunction with fundamental analysis for a more informed picture.

Understanding Market Cycles: Bulls, Bears, and Everything in Between

The stock market doesn’t move in a straight line. It experiences cyclical upswings (bull markets) and downswings (bear markets) over time. Bull markets can be exhilarating, with stock prices steadily rising. However, these periods are inevitably followed by corrections (short-term downturns) or bear markets, where prices experience significant declines. Understanding these cycles can help you manage your expectations and develop a long-term investment strategy.

The Power of Patience: A Long-Term Perspective

While short-term market fluctuations can be unnerving, successful stock investing revolves around a long-term perspective. Focusing on a horizon of 5+ years allows you to ride out market volatility and potentially benefit from long-term growth trends. While stock prices experience ups and downs, the stock market has historically offered a higher potential return than traditional savings accounts or bonds over the long term.

Building a Winning Strategy: Beyond Market Movements

Becoming a successful investor requires a well-rounded approach that considers your circumstances and risk tolerance. Here are some key strategies to develop:

- Define Your Investment Goals: Are you saving for retirement, a down payment on a house, or a child’s education? Your goals will influence your investment timeline and risk tolerance.

- Diversification is Key: Don’t put all your eggs in one basket! Spread your investments across different companies and industries. This helps mitigate risk – if one company or industry performs poorly, the impact on your overall portfolio will be lessened.

- Invest Regularly: Making regular, consistent investments allows you to benefit from dollar-cost averaging. This means you’ll buy more when prices are low and fewer when prices are high, potentially evening out your average cost per share over time.

- Stay Informed and Educate Yourself: The financial world is constantly evolving. Regularly reading financial news, attending investment seminars, and staying updated on market trends can equip you to make informed decisions.

- Don’t Chase Hot Tips or Get Emotionally Attached: Resist the urge to chase the latest stock market frenzy. Stick to your investment plan and focus on well-researched companies with strong fundamentals. Remember, emotions can cloud judgment – avoid making rash decisions based on fear or greed.

- Rebalance Your Portfolio Regularly: Due to market fluctuations, your portfolio’s composition might shift over time. Periodically rebalance your portfolio to ensure it aligns with your original asset allocation (the percentage of your investments allocated to different asset classes like stocks and bonds).

Navigating Market Psychology: Understanding Investor Behavior

The stock market is not solely driven by logic and numbers. Investor psychology plays a significant role in market movements. Here are some key aspects to consider:

- Fear and Greed: Fear can lead to panic selling, driving prices down even if a company’s fundamentals remain strong. Conversely, greed can motivate risky behavior, like investing in overvalued stocks or chasing hot tips. Staying rational and making decisions based on research and your investment strategy is crucial.

- Anchoring Bias: Investors can fixate on a stock’s past price, leading to poor decision-making. Don’t base your investment decisions solely on the initial purchase price. Focus on the company’s current and prospects.

- Confirmation Bias: Investors might seek out information that confirms their existing beliefs. Look for a balanced view – consider bearish and bullish viewpoints before making investment decisions.

Beyond the Basics: Advanced Market Dynamics

For those seeking to delve deeper, here are some additional factors influencing stock prices:

- Market Microstructure: How stock exchanges operate, including order types and trading algorithms, can impact price movements.

- Global Events: Major political or economic events around the world can trigger market volatility. Understanding global forces and their potential impact on specific sectors is crucial.

- Company-Specific Events: News announcements, mergers and acquisitions, or changes in leadership can significantly impact a company’s stock price. Stay informed about the companies you’ve invested in.

Investing for the Future: Embracing Knowledge and Discipline

The stock market, with its complexities and fluctuations, can be both daunting and exciting. By equipping yourself with knowledge, developing a sound investment strategy, and maintaining a long-term focus, you can navigate these dynamics with greater confidence. Remember, successful investing is a journey, not a destination. It requires discipline, continuous learning, and the ability to manage risk effectively.

Money Melon: Your Partner in Demystifying the Market

At Money Melon, we believe in empowering individuals to become informed and successful investors. We understand the complexities of the stock market and the challenges you might face. Here’s how we can support you:

- Educational Resources: Our library offers a wealth of information on stock market dynamics, covering topics like technical analysis, investor psychology, and advanced market concepts.

- Investment Planning Tools: Our online platform provides interactive tools to help you analyze market trends, assess your risk tolerance, and build a diversified portfolio aligned with your investment goals.

- Market News and Analysis: Stay informed with our curated news feeds and in-depth market analysis from experienced professionals.

- Connecting with Financial Advisors: Our team of qualified financial advisors can provide personalized guidance. They can help you navigate market complexities, choose suitable investments, and develop a long-term investment strategy tailored to your unique needs.

Embrace the journey of stock market mastery! By understanding the dynamics that drive price movements, developing a sound investment strategy, and partnering with trusted resources, you can build a brighter financial future.

FAQs:

- What’s the Difference Between Bull and Bear Markets?

Bull markets are characterized by rising stock prices and investor optimism. Prices tend to climb steadily over some time. Bear markets, on the other hand, experience significant price declines due to pessimism and fear. While bear markets can be unnerving, they are a natural part of the market cycle.

- How Does Technical Analysis Work?

Technical analysis studies historical price charts and trading patterns to identify potential future trends. Analysts use technical indicators like moving averages and relative strength index (RSI) to gauge investor sentiment, support and resistance levels (price points where buying/selling pressure is concentrated), and potential breakout points (where the price might experience a significant move). However, it’s important to remember that technical analysis is not a foolproof method, and past performance is only sometimes indicative of future results.

- What are Some Common Investor Psychology Mistakes to Avoid?

One major mistake is letting fear and greed dictate your investment decisions. Fear can lead to panic selling during market downturns, even if a company’s fundamentals remain strong. Greed can tempt you to chase overvalued stocks or invest based on hot tips. Another mistake is anchoring bias, where you fixate on the initial purchase price instead of focusing on the company’s current prospects. Finally, confirmation bias can lead you to seek information confirming your beliefs. It’s crucial to consider both bullish and bearish perspectives for informed decision-making.

- Is Dollar-Cost Averaging a Good Strategy for All Investors?

Dollar-cost averaging can be a powerful tool for long-term investors. This strategy involves making regular, consistent investments regardless of the current stock price. This allows you to buy more shares when prices are low and fewer shares when prices are high, potentially evening out your average cost per share over time. This can be particularly beneficial for mitigating the impact of market volatility.

- Should I Use Technical or Fundamental Analysis When Choosing Stocks?

Ideally, you’d want to consider technical and fundamental analysis when making investment decisions. Fundamental analysis focuses on a company’s financial health, profitability, and prospects. Technical analysis helps you understand investor sentiment and potential future price trends based on historical data. Combining these approaches can provide a more comprehensive picture of a company and its stock’s potential.

Leave a Reply